Business Insurance in and around Mount Vernon

One of Mount Vernon’s top choices for small business insurance.

Almost 100 years of helping small businesses

Business Insurance At A Great Value!

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, business continuity plans and extra liability coverage, you can rest assured that your small business is properly protected.

One of Mount Vernon’s top choices for small business insurance.

Almost 100 years of helping small businesses

Surprisingly Great Insurance

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent David Cooper for a policy that safeguards your business. Your coverage can include everything from worker's compensation for your employees or extra liability coverage to group life insurance if there are 5 or more employees or key employee insurance.

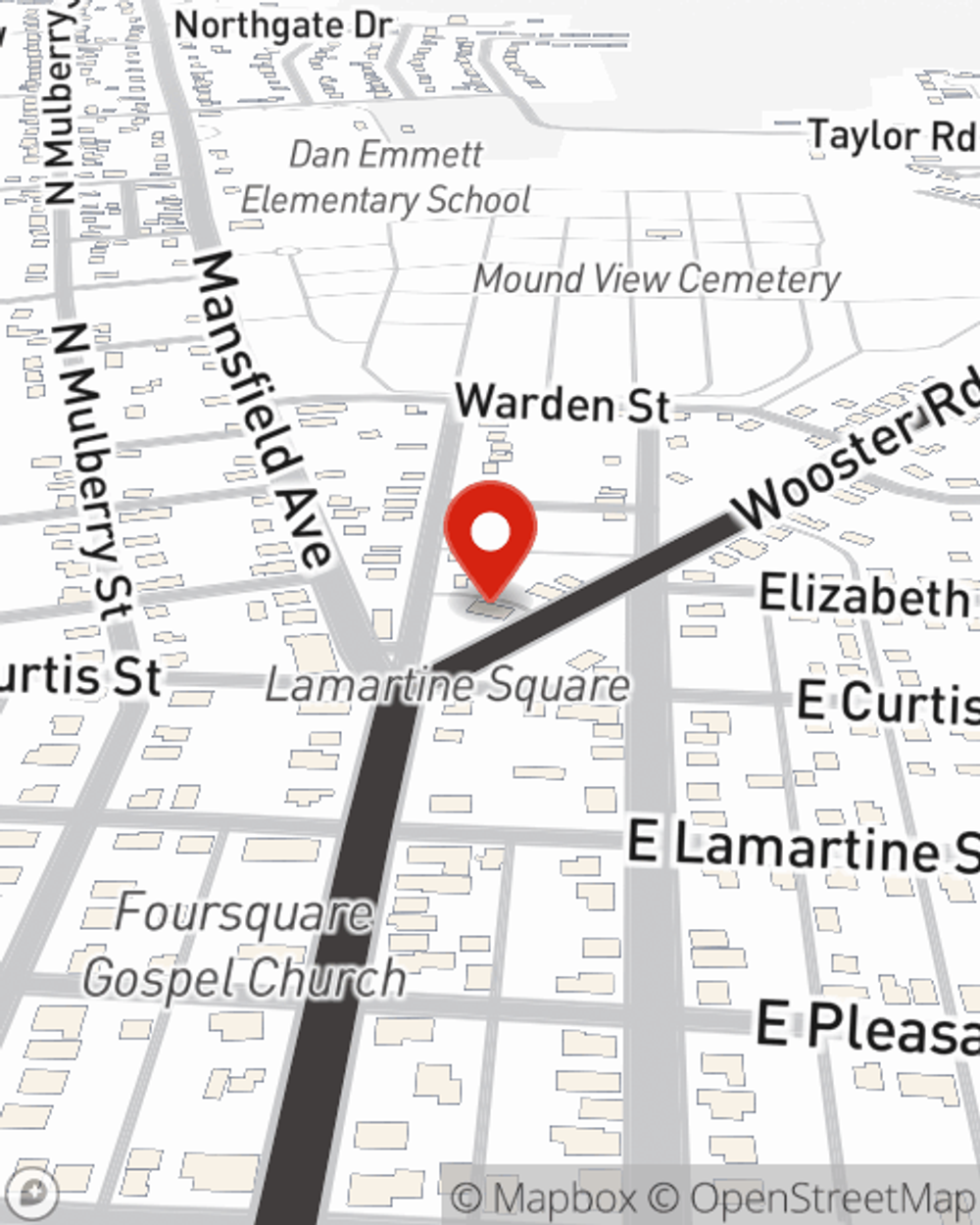

Ready to explore the business insurance options that may be right for you? Stop by agent David Cooper's office to get started!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

David Cooper

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.